- Rogers Community Forums

- Forums

- Account, MyRogers & Apps Support

- Account Support

- Re: No refund on the tax even after returning the ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

No refund on the tax even after returning the phone from lease???

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

02-22-2023

05:09 PM

- last edited on

02-22-2023

05:14 PM

by

![]() RogersZia

RogersZia

I'm on the Phone lease agreement with Rogers and my term is going to end and i got two options either to buyout the phone or return the phone. For buyout i have to pay $630. I'm planning to return my phone and get a new phone on lease again. And here are my questions i raised to the customer center of Rogers and they said its all valid ones but as per the policy they wont be able to refund me.

1. From the first month this is how my bill appears --- $45 dollars for the phone lease + 13 % tax for the lease + part of the tax on the remaining balance($630). When I asked them why they are charging me extra tax on the first month they said if i buyout the phone i wont be paying any taxes.

2. Now my lease is over and I'm planning to get a new phone again on the lease , so i should be eligible to get my taxes which i paid towards the remaining balance of the phone ?

***Edited Labels***

- Labels:

-

My Account

-

Upfront Edge

Re: No refund on the tax even after returning the phone from lease???

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

02-23-2023 04:36 PM - edited 02-23-2023 04:44 PM

Hello, @srinivasanselva.

I appreciate your interesting post, and welcome to our Community!

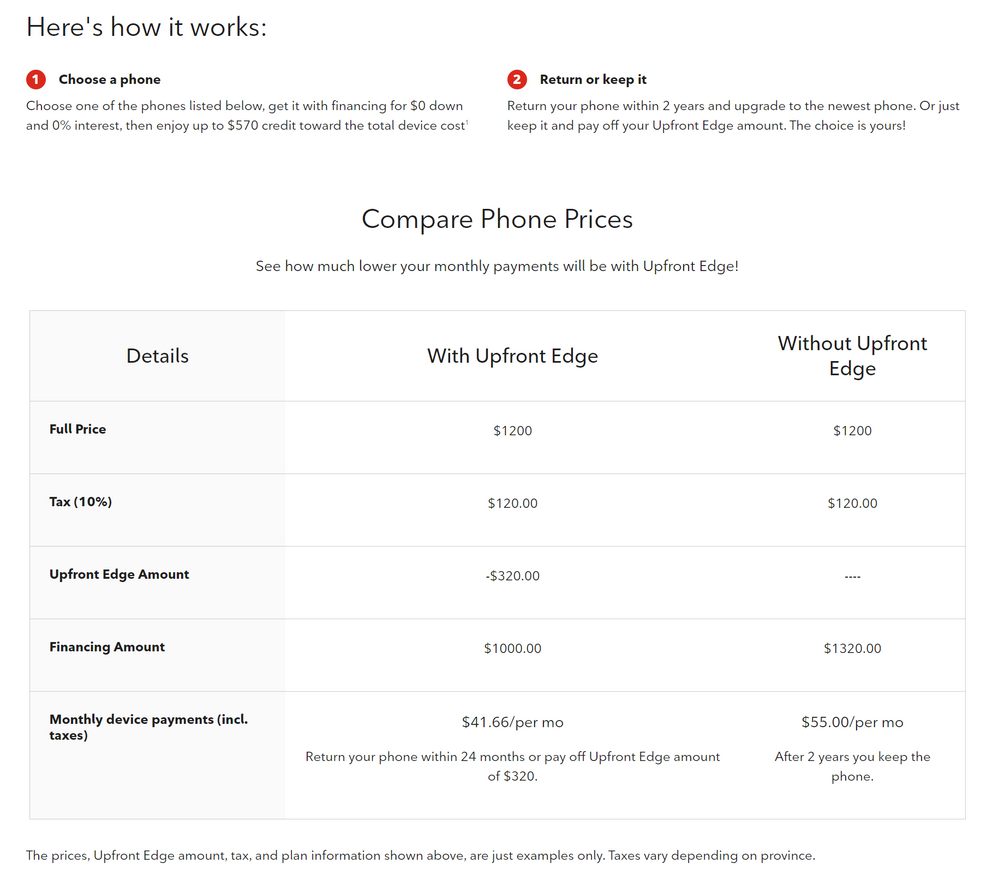

The Upfront Edge program makes getting select phones at a lower price more effortless. Upfront Edge lowers the monthly financing payments for a phone when the device is returned, in good working condition, in month 24 of the term. Or you can keep the device by repaying the Upfront Edge Amount.

The Upfront Edge amount is applied on the full device price after taxes, as shown on our Wireless portal.

I hope this clarifies how the Upfront Edge program works. For more info, you can check FAQs.

Cheers,

RogersMoin

Re: No refund on the tax even after returning the phone from lease???

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

02-23-2023 05:29 PM

Re: No refund on the tax even after returning the phone from lease???

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

03-30-2023 01:44 PM

Hello @srinivasanselva ,

Just to clarify, when you paid down the $120 at the time of purchasing the new device on Upfront Edge, was this a mandatory down-payment that was required based on your credit results? Or was this a recommendation from the Rogers rep?

Customers are allowed to make a voluntary down payment towards the cost of the device in increments of $120 at the time of their purchase transaction. For every $120 increment you put down, your device financing amount is reduced by $5 per month. With this being said, you wouldn't get this down payment back upon the return of your Upfront Edge device and upgrade to a new device since it's been credited towards your financing balance over the 24-month period.

I hope this clarifies!

RogersYasmine