- Rogers Community Forums

- Forums

- Lounge

- Community Lounge

- Rogersbank Mastercard Pay with Rewards - Eligible ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-22-2018 02:03 PM

Hi!

Does anyone know what counts as an "eligible purchase"? I downloaded the app yesterday and made a purchase on Amazon but when I checked today it said "this purchase is not eligible" in the app, with no explanation why.

I read the Legal section and it says you can redeem rewards towards eligible purchases but nowhere does it state what actually qualifies as eligible!

I called this morning but they could not tell me anything since I didnt have my card on me and couldnt give them the 3 digits on the back for security. I asked if they could tell me even GENERALLY what an eligible purchase is....and no, they couldnt, unless I have my card available.

So...can anyone help?? 🙂

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-22-2018 05:51 PM

Hello @mtl81,

Thanks for your post and Welcome to the Rogers Community Forums! 😃

I too was a bit confused at first in regards to what can be redeemed using your Cash Back points on your Rogers Mastercard. You can find the specific details by Clicking Here.

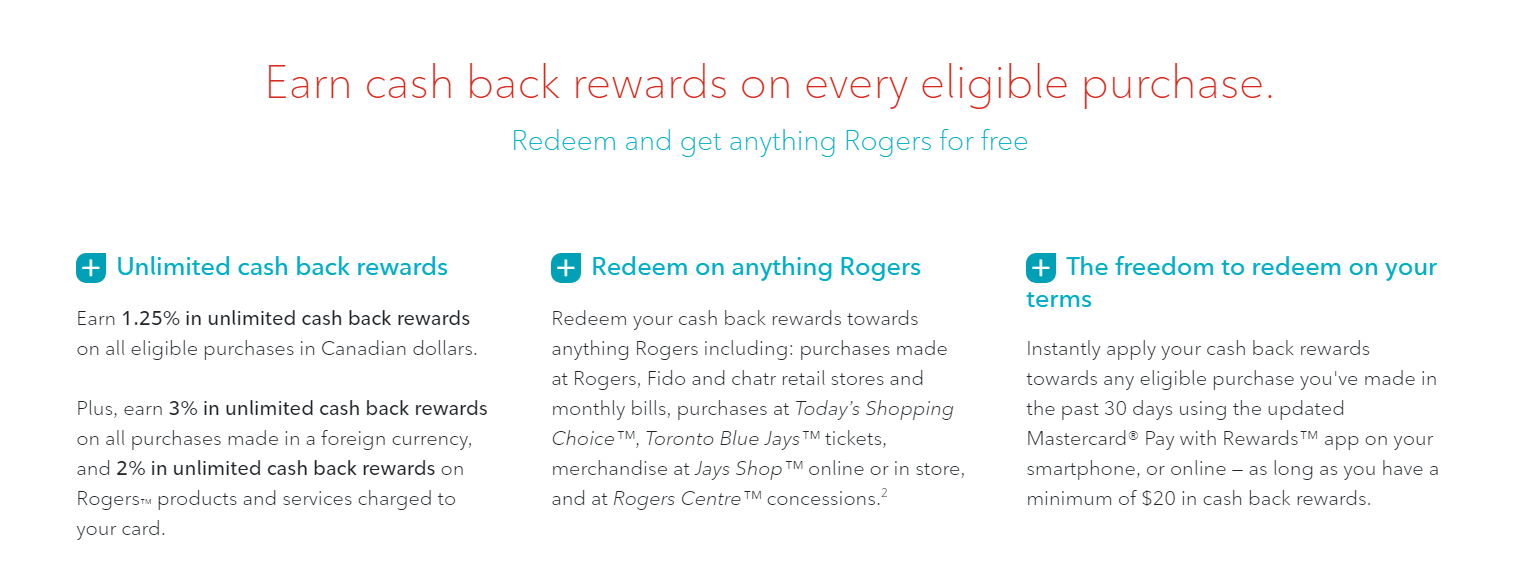

Below is a screenshot of the information you are looking for, specifically "Redeem on anything Rogers":

I hope this helps!

RogersTony

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-24-2018 07:39 AM - edited 06-24-2018 07:44 AM

@mtl81 ....Isn't it fun when they write these things up in Rogerese ??

I don't have a Rogers mastercard but have been around Rogers long enough to be able to sympathize with the lack of info and the hiding behind the privacy laws when even a general question is asked . My suggestion would be to bite the bullet and call in with the appropriate information .... it is the only way .. and document discussions as you go .

As I read your post ...Tony's info is still ambiguous at best in regards to the question I understand you to be asking and I see no answer unless you do not have the necessary $20 in rewards accumulated yet before attempting to redeem for "eligible purchases " .

Good luck . ![]()

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-24-2018 04:02 PM

Hey, here is a link with the terms and conditions https://rogersbank.com/legaldocs/en/Platinum_Terms_Conditions.pdf.

Number 3 will provide you details about what “Eligible Purchase” means.

Hope this helps.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-24-2018 11:53 PM

Interesting ....so that definition is hidden way down in a pdf in legal docs and in the ad that Rogers Tony referenced even the publisher of that ad refers to to what should be, by Rogers's definition "net purchases" erroneously as "eligible purchases" ... no wonder there is confusion . ![]()

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-26-2018 06:09 PM

the credits earned can only be applied to purchases from Rogers. Have your monthly Rogers bill charged automatically to your Rogers credit card

also Blue Jays tickets and other Rogers purchases can have your credit applied

credits are earned on any purchase here or abroad

new Rogers world elite card gets 4% on foreign purchases and 1 3/4% on domestic purchases. 2% on Rogers purchases

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 09:10 AM

Just curious why @mtl81 would need his /her card number and security code if the above info is the answer to the question ?

@lnw18 Is that only applicable to the APP ? You could still opt to just have the rewards credit applied to your account could you not rather than worrying about applying the credits to the " eligible purchases". ?

It just seems like much ado about spending more time on your phone without getting you any value benefit .

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 10:17 AM - edited 06-27-2018 11:13 AM

I agree, just set it up to send the rewards as credits to your Rogers MasterCard account automatically (up to the amount of your monthly Cable TV or Wireless bill for example). If you have over $20 in your rewards account at the time your Rogers account payment is due, it's automatically credited on the same day. No muss, no fuss. This assumes you pay your Rogers bill automatically using Rogers MC, which has other obvious benefits.

For those who need to do this manually for some reason, here's a previous post with links similar to the ones given previously here.

http://communityforums.rogers.com/t5/Community-Lounge/Rogers-MasterCard/m-p/414927#M1123

It's not always possible to provide all the wording for a particular benefit, etc on the website. The benefits are usually shown as a summary. Hence the link for Terms and Conditions, which can be quite long depending, but gives much more information than the website if needed.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 10:39 AM

the credits earned can only be obtained if applied against Rogers purchases. Once set up, no phone calls,no hassles.

I'm not a Rogers fan, but this card just works as spelled out. I get my credits each month applied to my credit card up to the amount I have charged Rogers purchases (TV, internet, home phone, wireless, Jays tix etc). It's really not complicated if you read the website

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 04:55 PM

@lnw18 wrote:the credits earned can only be obtained if applied against Rogers purchases.

So there is no point in someone not a Rogers customer getting a Rogers mastercard ?

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 06:59 PM

You don't need to be a Rogers customer - you can get credits once a year, which is not much different from many cards, although it's not automatic. From the T&Cs.

You may also redeem your Rewards in the form of an annual statement credit to your Account by calling Rogers Bank at 1 855 775-2265. You must request an annual statement credit for each year that you wish to receive it by December 1st of that year. Annual statement credits will be awarded in January of the following year and the amount credited will be the total dollar value of the balance of your Platinum Rewards Account as of the date the credit is issued to your Account.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 10:32 PM

@barndoor wrote:

@lnw18 wrote:the credits earned can only be obtained if applied against Rogers purchases.

So there is no point in someone not a Rogers customer getting a Rogers mastercard ?

I don't know about most people, but rewards are not the primary purpose for me to get a credit card, although it's okay if that works for you. I have 3 credit cards. I never thought I would need a second one because I always pay my balance off each month, but I've been the victim of CC fraud a few times so getting a second one was necessary while waiting for a new primary one. Then I got suckered into a PC Mastercard for a bag of cookies, which I now only use for gas purchases. No harm in having multiple credit cards so long as they don't cost anything and you keep track and pay them off each month.

Rogers PayGo. Location: S-W Ontario

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 11:02 PM

Credit card has no real purpose if you don’t buy any Rogers products. As spelled out credits can only be applied to Rogers purchases

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 11:46 PM

@lnw18 : I suggest you read post 11 of this thread.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

06-27-2018 11:56 PM - edited 06-27-2018 11:58 PM

@OLDYELLR wrote:

I don't know about most people, but rewards are not the primary purpose for me to get a credit card, although it's okay if that works for you.

Since there is no bonus for paying cash anymore if you can get a 1.5% reward for using your card and then paying it off by the due date ....it's not hard to accrue a $200-300 reward over the year . Even with a credit card it should not be about whether it costs YOU anything but how much THEY are going to pay YOU for your business . ![]()

Bummer about the fraud tho ....may karma bite the fraudsters hard .

@lnw18 ... maybe that info you read was not as uncomplicated as you thought . ![]()

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

02-20-2019 01:45 PM

Hi - I just tried to redeem a bunch of points on my Rogers Bank MC towards a bill payment on my wireless phone account through the mobile app. Seemed easy enough. However, I got an email a couple days later saying the redemption was ineligible (even though the app said it was, and allowed me to actually do it!).

On top of that, after being notified that the transaction was ineligible, the points I redeemed were never returned to my account. So now I'm out of a boatload of points AND a transaction that on paper looked eligible is not eligible.

PS - the email address on the MC pay with rewards website for 'Contact Us' sends me a bounce back.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

02-21-2019 12:52 PM

Hello @JS811906,

We appreciate your presence in the Rogers Community Forums and congrats on your first post! 🙂

It's one thing that your points redemption got declined after submission, but I'm super shocked and disappointed to hear that these points were not credited back to your account afterward!

If you still do not see your points returned to your account, I would definitely recommend that you reach out to our Rogers Bank Customer Care team for help. I wish we could check into this for you here in the Community Forums, but unfortunately, we do not have access to the tools needed to investigate further.

Here is how you can contact our Rogers Bank Customer Care team:

By Phone: 1-855-775-2265 (Available 24/7)

After speaking with them, feel free to post an update in the Community as we would love to know the outcome!

RogersLaura

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

04-10-2019 11:02 PM

does anyone know if Shaw internet is considered an "eligible" purchase? we have rogers phone out here but only Shaw for internet.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

04-11-2019 01:01 AM

@DontWantThis : Check out the following thread regarding new eligibility rules. Although I don't know about Shaw Internet, a huge number of purchases are now eligible. I just reviewed my recent purchases and found the following available for redemption:

- Some groceries

- Some Liquor store purchases

- Some restaurants

- Some other shopping.

I don't believe you should find any problems redeeming your points for something as I found about 30% of my purchases qualify.

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

04-12-2019 02:43 PM

thats helpful thanks.

I wasnt thinking about redeeming though. I was wondering about purchases with the card. Are ALLpurchases eligible for 1% back regardless of the categories? Or are some purchases just 0 cash back? If I make my shaw bill come off this card now, will I get any "rewards" for that.. or do I just get nothing because its not in a category?

Re: Rogersbank Mastercard Pay with Rewards - Eligible Purchases?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Content

04-12-2019 05:17 PM - edited 04-12-2019 05:18 PM

All regular purchases (like your Shaw payments) are eligible, however, the amount of "reward" depends on the type of purchase and the Card used. See the rewards outlined in the following link. They vary from 1.25% to 4% on foreign purchases on the Elite Card.

https://www.rogersbank.com/en/

If you click on the "legal disclaimers" on the bottom of the page, it lists the ineligible items